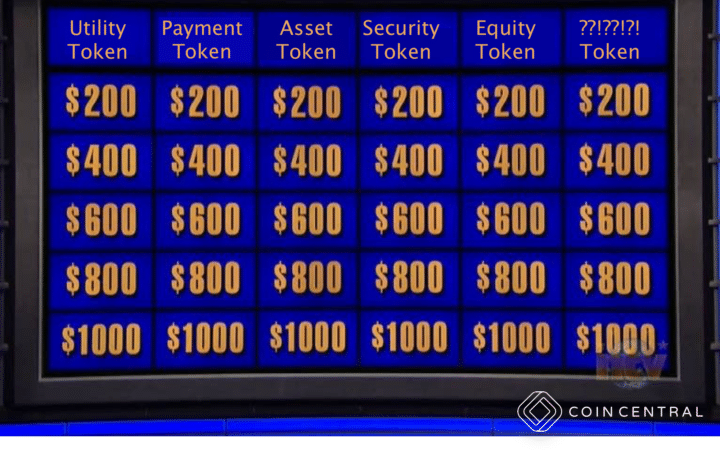

Governments have started to intervene in matters of cryptocurrency and ICOs. So it has become ever-more important for investors to understand which cryptocurrency categories are which. Coincentral has previously pointed out the need for a single robust framework and assessed some of the frameworks already issued.

While there is still no community consensus on which is the correct framework to use, regulators are nevertheless starting to take notice. It is, therefore, more critical than ever before that investors understand cryptocurrency categories and their regulatory position. Knowing this kind of information will help in making a realistic risk assessment of your portfolio. Understanding categories of coins will also help drive sound investment decisions.

Here, we will summarize some of the broader categorizations of tokens, with a focus on those that are subject to regulatory scrutiny in major ICO jurisdictions.

This article will not try to introduce a new framework of cryptocurrency categories into an already confusing, and confused, environment. Instead, it aims to bring clarity to some of the token terms currently flying around. Due to the sheer volume of tokens available in the current market, you may find that some will fit more than one definition.

This list is not exhaustive and does not in any way represent legal or financial advice.

Regulatory Guidance on Cryptocurrency Categories and ICOs

The top five countries for ICOs, both by the number of projects and by funds raised, are the United States, the United Kingdom, the Russian Federation, Switzerland, and Singapore.

Of these five, only the United States and Switzerland have issued concrete statements on the treatment of ICO tokens and cryptocurrency classifications at the time of writing. Singapore and the UK have both taken the position that they will assess each case under current regulatory rules. The Russian Federation has said it supports a draft bill currently passing through the state government, but as yet nothing has been finalized.

Therefore, in these definitions, we will incorporate the guidance issued by financial regulatory authorities in the US (SEC) and Switzerland (FINMA) for different cryptocurrency categories.

Payment Tokens

A payment token or currency token is the purest form of cryptocurrency. It operates in much the same way as fiat currency or a credit card does. It does not put any obligation or rights onto the bearer. A payment token is a store of value, exchangeable for other things of value.

Both the SEC and FINMA have been relatively clear that long-existing payment tokens such as Bitcoin are likely not to be regulated as securities. The issue of new payment tokens in an ICO could in fact still fall under regulatory control due to investment rules described for utility tokens, below.

Asset Tokens

Asset tokens are potentially the most complex of cryptocurrency categories. They represent a real-life asset or part thereof – something that holds value. This could be a physical asset like a gemstone, or real estate. Asset tokens are increasingly used to create “digital twins” to track real-life assets. For example, the UK Royal Mint has a blockchain project to tokenize gold traded on the London Gold Market.

Asset tokens will be subject to heavy scrutiny by regulators to see if they fall under securities legislation. An asset token puts particular obligations and rights on the buyer and seller. So FINMA and the SEC will both likely treat asset tokens as securities. This does depend on the nature of the underlying asset and the terms of trading.

Security Tokens and Equity Tokens

Security tokens are a narrower form of asset tokens. Outside of crypto, securities include financial instruments such as stocks, bonds, and options. The SEC’s definition of a security is based on the Howey Test, and it states:

If there is an investment of money, and a common enterprise, with the expectation of profit, primarily from the efforts of others.

The SEC has already ruled that The DAO was an organization set up with voting rights by participants in exchange for financial buy-in. As its participants were no different than shareholders, The DAO would have been subject to US regulations regarding trading of securities.

An equity token is a form of security token. It represents a kind of fractional ownership of a company or undertaking, similar to a share. As shareholders have rights, such as voting on major decisions affecting the company, then it is relatively clear-cut that regulators will define them as securities.

Utility Tokens

A utility token is one of the cryptocurrency categories that the regulators say should serve no investment purpose. It exists merely so that a user can access a particular platform or application. Pure utility tokens are not securities. Therefore, many ICOs are now styling their tokens as utility tokens to try and circumvent legislation in this regard.

Regulatory Rulings on ICOs as Securities

However, the ICO is where things get sticky for utility and payment tokens. An ICO is essentially a crowdfunding effort. Investors buy utility tokens and HODL, in the hope that their chosen project will take off and therefore the tokens will rise in value.

This means that many ICOs that are ostensibly offering tokens in the cryptocurrency categories of utility or payment tokens are likely to be classed as securities due to the US Howey Test, which specifies investment of money, common enterprise, and expectation of profit, primarily from the efforts of others. Hence many ICOs now exclude US persons, unless they are accredited investors.

FINMA is less rigid, specifying that “If a utility token additionally or only has an investment purpose at the point of issue, FINMA will treat such tokens as securities” (i.e., in the same way as asset tokens). Here, it is still likely that utility token ICOs would come under securities laws. However, Swiss regulations regarding securities trading tend to be less onerous than in the US. Hence many ICOs in all cryptocurrency categories remain open to Swiss investors, at least for now.

Can Utility Token ICOs Bypass US Securities Regulations?

Earlier this year, SEC Director of Corporate Finance William Hinman faced questioning over whether an ICO could happen without a security offering. His response threw some light on the possibility of ever running a compliant ICO. He stated, “We certainly can imagine a token where the holder is buying it for its utility and not as an investment, and in those cases, especially if it’s a decentralized network in which it’s used, and there are no central actors who have information asymmetries or where they would know more than token investors.”

Ultimately if an ICO is involved then the regulators are likely to get involved. This is the case even if the token is a genuine utility or payment token.

I’m Not in the US or Switzerland – Why Should I Care?

Regulators are generally slow to follow technology. So it is inevitable that more countries will start to issue similar guidelines to the US and Switzerland. Particularly bearing in mind that these governments have moved quickly due to the volume of ICOs in their jurisdictions.

In any case, investors based in currently unregulated countries should have some understanding of cryptocurrency categories. After all, if you don’t know what kind of token you are looking at, then how can you assess whether that token stands any chance of paying out decent returns in the long term?

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.